CBRT July 2025 Interest Rate Decision and Its Impact on the Real Estate Market

Economic and Political Background

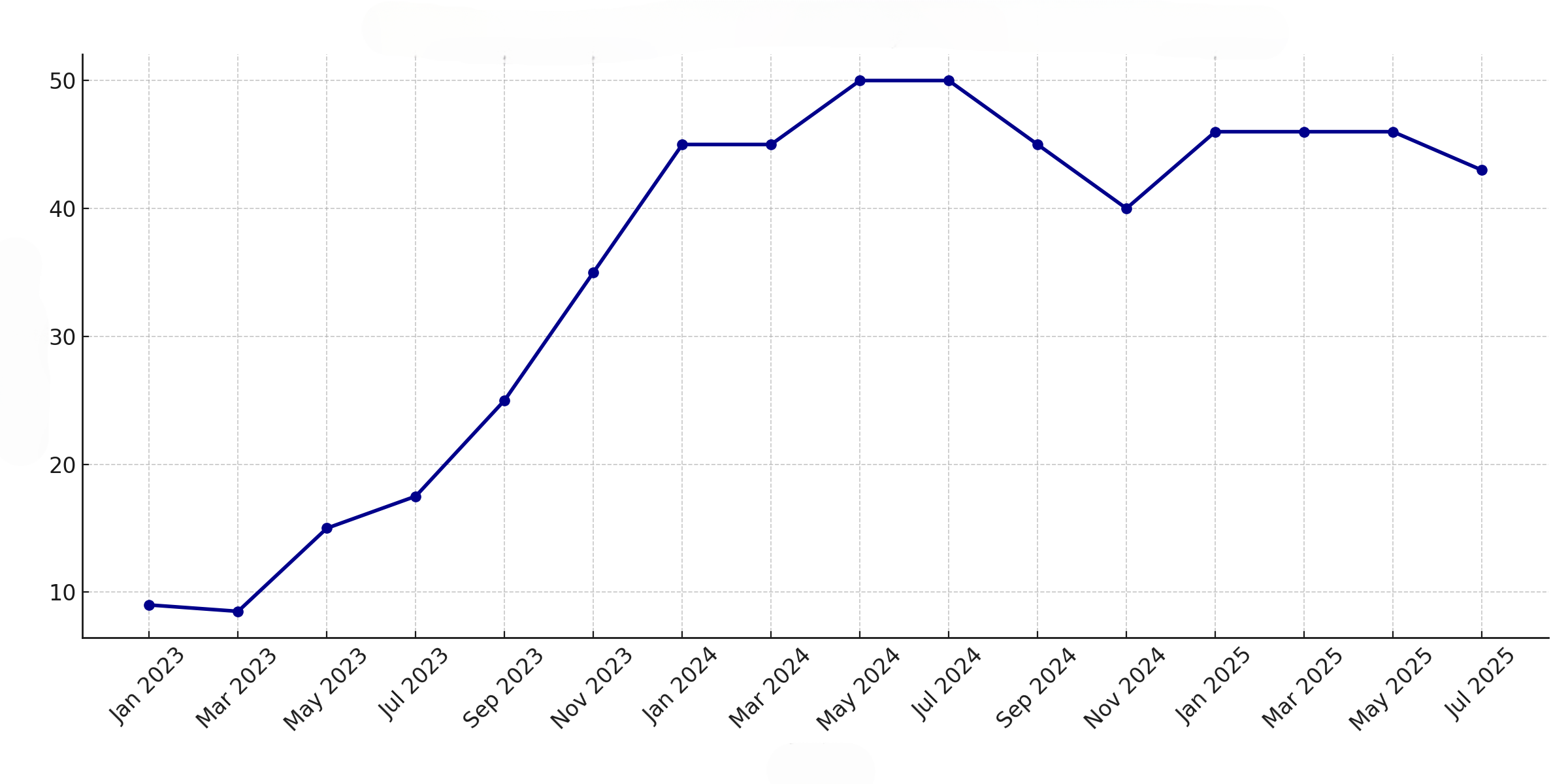

The first half of 2025 was quite turbulent for the Turkish economy. Following the detention of Istanbul Metropolitan Mayor Ekrem İmamoğlu, protests and international reactions shook investor confidence. In April, the USD/TRY exchange rate exceeded 41, prompting the Central Bank of the Republic of Turkey (CBRT) to intervene aggressively to support foreign exchange reserves. During this period, the policy interest rate was increased to 46%.

Interest Rate Decision Details

On July 24, 2025, during the Monetary Policy Committee meeting, the CBRT lowered the policy interest rate from 46% to 43%. Additionally, the lending rate in the late liquidity window was reduced from 49% to 46%, and the borrowing rate was cut from 44.5% to 41.5%. This 300 basis points cut marked the most significant move of the year.

Impact on Prices: Increase or Stabilization?

The rapid rise in housing prices in recent years may gain new momentum with the interest rate cut. However, the key factor to watch is whether the supply will increase simultaneously with the growing demand...

Interest Rate Decision

| Type | January 2025 | July 2025 |

|---|---|---|

| Policy Rate | 46% | 43% |

| Overnight Borrowing | 44.5% | 41.5% |

| Overnight Lending | 49% | 46% |

This was the most aggressive single move of the year by the Central Bank.

Justifications: Inflation and Monetary Policy Communication

In June, the underlying trend of inflation remained flat. According to the Central Bank of the Republic of Turkey (CBRT), signs of weakening domestic demand have increased, reinforcing the disinflation process. The CBRT emphasized that it will take meeting-by-meeting and data-driven actions and stated that it will activate all available tools when necessary.

Market Reactions and Economic Impact

Following the decision, the Turkish Lira remained stable, while the BIST 100 index gained 1%. Annual inflation dropped to around 35% in June, down from over 75% in May 2024. The year-end inflation forecast was revised to below 30%. According to a Reuters survey, the policy interest rate is expected to decline to 36% by the end of the year.

Analyst Comments and Expectations

Capital Economics stated that the interest rate cut indicates the Central Bank’s confidence in the decline of inflation. However, a cautious approach to monetary policy will be maintained. JPMorgan and other international institutions forecast the year-end policy interest rate to be in the 36–37% range.

Impact of the Interest Rate Decision on Turkey’s Real Estate Market: Is a New Momentum on the Horizon?

The 300 basis points interest rate cut by the Central Bank of the Republic of Turkey (CBRT) on July 24, 2025, is likely to create significant effects not only in financial markets but also in the real estate sector. Any change in the policy rate directly and indirectly affects the housing market in terms of property sales, mortgage interest rates, and investor behavior.

1. Expectations of Easing in Mortgage Interest Rates

The reduction of the policy rate from 46% to 43% suggests that mortgage interest rates may also decline in the coming weeks.

Although mortgage rates had risen to 3.5–4.0% levels since the beginning of 2025, these rates may fall back to around 2.5% if the CBRT continues to lower interest rates.

This development could make home purchases attractive again for domestic buyers in the middle-income segment. The stagnation in property sales over the past two years—due to high inflation, limited access to credit, and rising costs—may start to show signs of recovery, particularly in major cities.

2. Increased Demand from Domestic Buyers and the Return of Postponed Purchases

The CBRT’s rate cut could create a perception of a “turning point” in the market. If the belief becomes widespread that interest rates have peaked, individuals who have long postponed purchasing decisions may start to act.

Demand may rise for both new and second-hand family-type homes in major cities such as Istanbul, Ankara, and Izmir.

At the same time, investments in coastal holiday regions may become more attractive in Turkish Lira terms, as the stabilization of the exchange rate encourages local investors to once again turn to alternative real estate opportunities.

3. A Window of Opportunity for Foreign Investors

Due to high interest rates and exchange rate volatility in recent months, foreign property purchases had slowed down — but are now likely to pick up again.

Investors from Gulf countries, Central Asia, and Europe may see Turkey as a more accessible market as the Turkish Lira begins to gain real value and interest rates decline.

Additionally, Turkey’s citizenship incentives (such as the right to Turkish citizenship with a property purchase of $400,000) and decreasing costs could lead foreigners back to seaside developments or luxury apartments in city centers.

Suitable for Citizenship Apartments

IS-4557, Smart Investment in Zeytinburnu! Luxury Sea‑View Apartment with Pool, Parking & Prestige in One

✔️ 4 rooms · 2 bathrooms · Terrace · Pool · Suitable for Turkish Citizenship

Sea-View 5-Room Apartment with Balcony & Pool in Istanbul Buyukcekmece

✔️ 5 rooms · 3 bathrooms · Balcony · Sea View · Pool · Suitable for Turkish Citizenship

54 m² Commercial Property in Central Beşiktaş with High Rental Potential

✔️ Commercial unit · 54 m² · 24/7 security · High rental yield · Citizenship eligible investment

4. Revival in the Construction Sector and New Projects

The interest rate cut impacts not only the sales of existing properties but also directly affects the financing of new housing projects. As costs become more predictable, developers may:

- Increase applications for new construction permits,

- Restart previously halted projects,

- Bring forward delayed project launches.

If combined with supportive government policies—such as VAT exemptions or reductions in title deed fees—employment and production in the construction sector may regain momentum.

5. Impact on Prices: Increase or Stabilization?

The rapid rise in housing prices in recent years may gain new momentum with the interest rate cut. However, the key factor to watch is whether the supply will increase simultaneously with the growing demand:

- If demand rises while supply remains constant, prices may once again trend upward.

- However, if new projects are quickly launched, the market may reach a balance.

Additionally, in the short term, the interest rate cut is more likely to affect the number of transactions rather than prices. Over the past 12 months, property sales have dropped by up to 35%, and the second-hand market has experienced significant contraction.

🔍 Expert Insight

Real estate expert Marco Sayed offers the following assessment regarding the decision:

“The interest rate cut is a long-anticipated step. It may trigger a return of domestic buyers.

Foreign investors are also likely to refocus on Turkey as the Turkish Lira stabilizes.

However, in order to prevent prices from rising too rapidly, a balanced supply-demand policy is essential.”

Conclusion: Cautious Optimism in the Real Estate Market

The CBRT’s initiation of an interest rate reduction process has strengthened signs of recovery in the real estate sector. However, market players expect this process to be managed in a stable, controlled, and predictable manner.

The real estate sector continues to be one of the major driving forces of the Turkish economy. As a result of the interest rate decision, an increase in market activity, a rise in sales volumes, and an expansion in credit usage are expected in the coming quarters.

The CBRT’s July decision is seen as the beginning of a carefully managed easing strategy. Activity is anticipated not only in real estate but also across many sectors. Nevertheless, economic and political uncertainties must continue to be closely monitored. Transparency in monetary policy and a data-driven approach will ensure the process moves forward safely.

AR

AR DE

DE RU

RU TR

TR