Turkey’s adjustment of its citizenship-by-investment program reducing the entry threshold from $1,000,000 to $250,000 in 2018 and later setting it at $400,000 — has fueled sustained demand among international property investors. The nuance, however, is that residency status and investment merit are not the same variable; a property can be perfectly acceptable for citizenship purposes and simultaneously poor as a financial asset. In Istanbul, where micro-locations change from one street to the next, acquisition discipline is the difference between a resilient investment and a fragile one. The framework below doesn’t rely on marketing promises or generalizations; it shows exactly how to evaluate price on entry, income during the hold, and exit at the end—three levers that together determine whether your pro-forma converts to realized profit.

The Three Pillars of a Sound Istanbul Investment

Istanbul Investment Playbook

1) Buy Below Market Value: Equity Is Created at Purchase

Investors often focus on post-purchase appreciation because it is intuitive to imagine a rising line on a chart. Yet the most reliable alpha in Istanbul property comes from the purchase discount versus demonstrable comparables. The task is to build a comp set that isolates the signal from the noise: same micro-location (not merely the same district), similar building age and specification, comparable floor level and orientation, and equivalent access to transport, schools, and retail. Reduce each comp to a clean price-per-square-meter and reject outliers caused by unique features (penthouse terraces, atypical renovation quality, forced sales). The aim is to derive a defensible band of value rather than a single magical number. Once you have that band, negotiate to the lower bound or below it; the delta between your closing price and the band’s midpoint is your built-in equity and the first line of defense against market volatility.

Buying below market value has second-order benefits that compound over time. First, it improves your gross-to-net conversion, because building dues, maintenance, and vacancy are paid in nominal currency while your rent scales with lawful indexation; a lower basis means these fixed frictions consume a smaller share of effective yield. Second, it increases your optionality at exit. If the market softens, you can price to move and still protect your capital. If the market strengthens, your return magnifies because both components—income and capital gain—are anchored to a disciplined basis. In practice, a 3–5% discount against a clean comp average is meaningful; 8–12% is transformative, provided quality and liquidity are not compromised to “win” a discount that later proves illiquid.

Practical checklist for comps: micro-location parity, building age/spec parity, floor/orientation match, similar access to transport/schools/retail, normalize to ₺/m² or $/m², remove outliers (penthouses, atypical renovations, forced sales).

Target: 8–12% discount

Istanbul Investment Playbook

2) Secure a Stable Income Stream: From Gross Yield to Net Cash Flow

Headline yields in brochures are gross figures that ignore practical frictions. To underwrite income realistically, begin with a conservative view of market rent supported by active listings and, where possible, evidence of recently signed leases for comparable units. Istanbul’s average gross yield is often around 5%; this is not a ceiling so much as a baseline that can be exceeded when purchase price is disciplined and the unit is positioned for broad tenant appeal. The underwriting then translates gross rent into net operating income (NOI) by subtracting recurring items: service charges/building dues, routine maintenance, landlord-paid utilities if any, management fees where applicable, and a sensible allowance for vacancy/turnover (even strong markets require repainting, minor fixes, and marketing in between tenants). The output you care about is effective yield on cost—NOI divided by your total acquisition cost, including taxes and closing fees.

A key Istanbul-specific nuance is lawful indexation of rent, which allows the contract to track inflation subject to caps and current regulations. Rather than day-one overpricing—which increases time-to-let and invites early renegotiation—set the initial rent at the market-clearing rate and let indexation do its work. Investors who buy right and manage proactively often see an initial ~5–6% gross yield evolve into 6–6.5% and, by years three to four, 7–8% effective on historic cost as the rent roll climbs while the original basis remains fixed. This “denominator effect” is not financial engineering; it is simply the compounding of modest annual adjustments on top of a disciplined purchase price.

Quick underwriting guide: start with real rent data, deduct dues, maintenance, utilities, management, and vacancy, then divide NOI by total acquisition cost to obtain true yield on cost.

Target: 6–8% effective yield

Istanbul Investment Playbook

3) Design a Real Exit Strategy: Liquidity Lives with the Local Buyer

Profit is not a spreadsheet value; it is the cash that remains after you sell. In Istanbul, the overwhelming majority of transactions occur between local buyers, which means the design brief for a saleable asset is not what appeals to international investors but what the domestic buyer pool actively chooses. That preference set is neither mysterious nor arbitrary: practical interior layouts with genuine living space, bedrooms that accept full-size furniture, kitchens and bathrooms with durable finishes rather than show-home fragility, and connectivity to metro/Metrobus and key arterials that compress commute times. Neighborhoods with schools, healthcare, and daily retail within a short radius trade with velocity; buildings with reasonable dues and competent management keep owners and tenants aligned. If you can describe your likely buyer profile three to five years from now and your unit’s attributes map to that profile, you have the bones of a credible exit strategy.

Design for the Domestic Buyer

- Practical layouts; real living/dining space

- Bedrooms sized for full furniture

- Durable, easy-to-maintain finishes

- Reasonable building dues & sound management

Location & Connectivity

- Walkable access to metro/Metrobus or arterials

- Schools, clinics, and daily retail nearby

- Safe, well-managed streets and blocks

- Micro-location liquidity over “brand” hype

Exit checklist: Who is your most probable buyer in 3–5 years? Does your unit’s layout, finish quality, dues level, and transport access cleanly match that buyer profile? If yes, you have a saleable asset with real liquidity.

“You may think you’ve made a 30% profit, but if you can’t sell the property, it’s just numbers on paper.”

Translating Exit Strategy into Underwriting

An exit is not an afterthought that begins when your holding period ends; it is a present-tense constraint that should shape what you buy today. Start by stress-testing the days-on-market in your target micro-location by examining how long comparable units take to transact and what concessions (price, included appliances, minor refresh) are typical. Next, model two exit cases: a base case in which capital values appreciate at a conservative clip—say, ~7% per annum for quality stock—and a soft case in which values stagnate or even retrace modestly. Your purchase discount and rental performance should still deliver an acceptable internal rate of return in the soft case. Finally, survey the pipeline: permits and marketing for new projects within a 1–2 km radius that may come online before your planned exit. If your asset competes head-to-head with future new supply, you must either buy at a deeper discount or choose a differentiated spec/location that de-risks your resale.

Exit preparation also touches micro execution details that are easy to postpone but expensive to fix late. Favor layouts that minimize wasted corridor space and support furniture placement without custom carpentry; prioritize orientation and glazing that admit natural light without punishing heat gain; and verify acoustic performance between units and in shaft locations where noise transmits. These are not luxuries—they are the invisible reasons why two “similar” apartments have very different viewing-to-offer conversion rates. When the time comes to sell, the unit that “just works” for the typical local household sells first and holds its price.

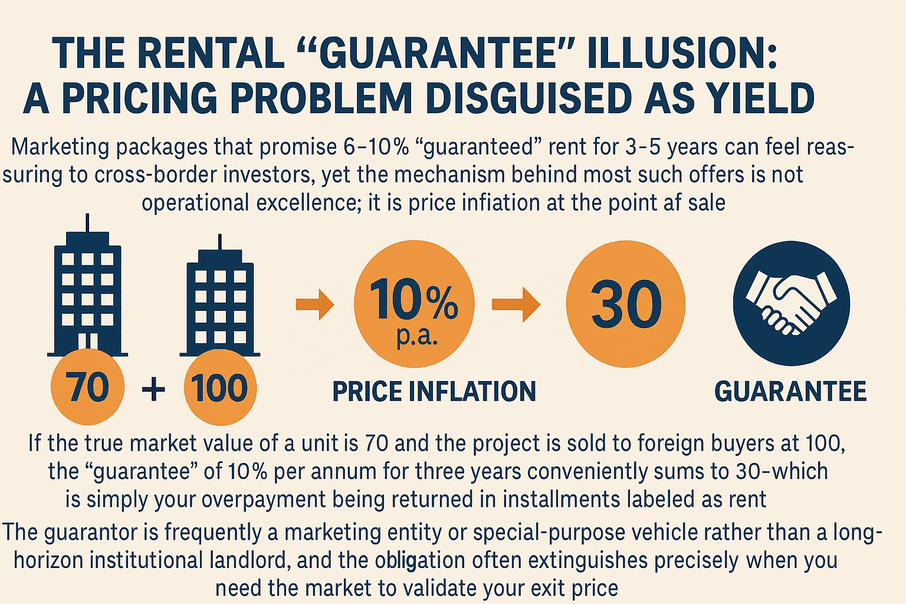

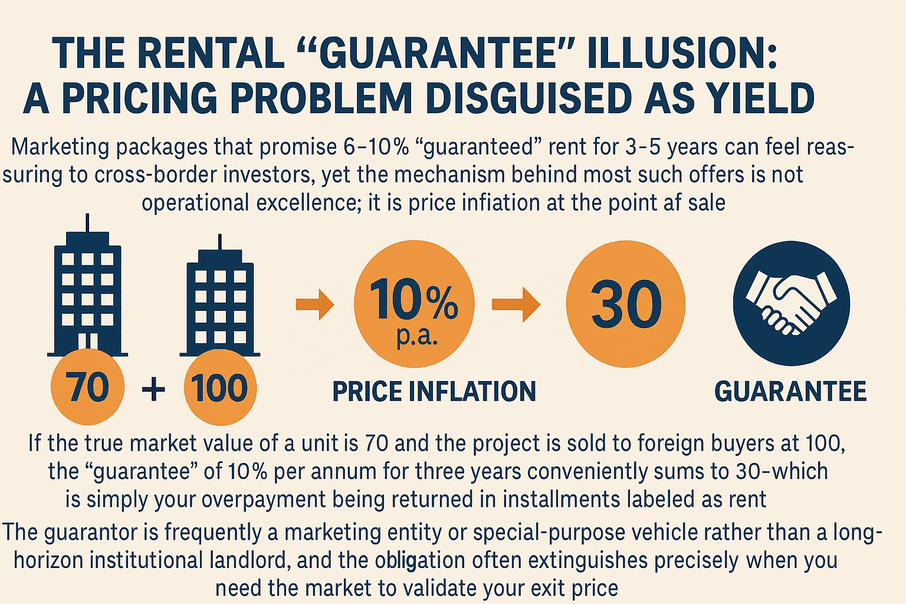

The Rental “Guarantee” Illusion: A Pricing Problem Disguised as Yield

Marketing packages that promise 6–10% “guaranteed” rent for 3–5 years can feel reassuring to cross-border investors, yet the mechanism behind most such offers is not operational excellence; it is price inflation at the point of sale. The arithmetic is blunt. If the true market value of a unit is 70 and the project is sold to foreign buyers at 100, the “guarantee” of 10% per annum for three years conveniently sums to 30—which is simply your overpayment being returned in installments labeled as rent. The guarantor is frequently a marketing entity or special-purpose vehicle rather than a long-horizon institutional landlord, and the obligation often extinguishes precisely when you need the market to validate your exit price.

Market Reality

Inflated Offer

What You Receive

70 (true value)

100 (sale price to you)

10 + 10 + 10 over 3 yrs = 30

The problem is not merely semantic; it manifests at resale. When you attempt to exit after the guarantee period, the local market does not capitalize your brochure yield; it compares your unit against nearby alternatives and pays something closer to intrinsic value. If you bought at 100 in a 70 market, any “income” you enjoyed upfront is offset later by a weaker sale price—sometimes in the 90–95 band or worse—leaving total return inferior to a plain, well-bought asset without gimmicks. The antidote is straightforward: compare price per m² against 3–4 true comparables. If the “guaranteed” project carries a 30–50% premium, you are likely financing your own rent.

Istanbul’s Rental Reality: High Demand, Professional Execution

Istanbul’s scale and mobility generate robust, persistent rental demand across price bands. As a landlord, your task is not to extract the highest sticker rent on day one; it is to reach market-clearing rent quickly and maintain occupancy with tenants who pay on time and stay longer. That usually means pricing within the range supported by current listings, presenting a scrupulously clean and functional unit, and responding promptly to early maintenance tickets that build trust. Over time, lawful indexation and reputation with your property manager matter more to total return than a one-off attempt to maximize the first lease by 3–4% above market, which often backfires as extra vacancy days and churn.

When underwritten this way, the math becomes repeatable rather than aspirational. A baseline ~5% gross yield is a fair starting assumption for many central and well-connected submarkets. Purchase discipline and smooth operations can lift that into the 6–6.5% range without strain, and by years three to four you frequently observe 7–8% effective yield on historic cost as cumulative indexation compounds. Layer a conservative capital growth assumption—say, ~7% per annum for quality, liquid stock—and your three-year outcome aligns with what experienced investors report: real cash returns that do not rely on artificial guarantees.

Case Study: Packaging vs. Fundamentals

Scenario A — “Guaranteed” Deal

Consider an acquisition at 100 for a unit whose intrinsic value is ≈70. Over three years you collect 10% per annum labeled as guaranteed rent, totaling 30. The optics are excellent—clean monthly payments, polished brochures, maybe even a hospitality logo. Yet at exit, the local resale market benchmarks your unit not against your contract but against available alternatives and the last round of transacted prices. If bids cluster at 90–95, your total economics reveal that the “income” was simply a return of your own capital, and the resale haircut consumed the advantage. The structure substituted timing of cash flows for creation of value.

Scenario B — Market-Priced Deal

Now consider a purchase at 100 that is fair or slightly below comps, with no guarantee scheme. You lease at a realistic market rate, producing ~6% per annum gross (≈18 over three years), and your exit models a conservative ~7% annual capital gain. Even without compounding in the illustration, that implies a move to ≈120 by year three; in practice, compounding and micro-location momentum can do slightly better. The combined effect—≈38–40% from rent plus capital—was generated by fundamentals: disciplined entry price, competent leasing, and alignment with local buyer demand at exit. Nothing in this scenario requires financial choreography; it simply respects how the Istanbul market actually clears.

Five-Step Playbook for Analytical Foreign Investors

1) Micro-Location First

Define a tight search radius around commuting nodes and daily-life anchors. In Istanbul, walking access to metro/Metrobus, proximity to arterial roads, and adjacency to schools and retail determine both rentability and resale. Audit street acoustics, block orientation, and sightlines to avoid units that look good on paper but underperform in viewings due to noise or poor light.

2) Build a Clean Comp Set

Assemble at least 3–4 like-for-like comparables. Normalize to price per m², strip out outliers, and document the micro reasons for any residual spread (floor premium, renovation, view). Target acquisition at or below the weighted average and be ready to walk if the seller anchors to brochure rhetoric rather than transactable value.

3) Underwrite Income Like a Manager

Validate rent against active listings and recent leases, not just agent anecdotes. Convert gross to NOI by modeling dues, turn costs between tenancies, and a modest vacancy factor. Include lawful indexation, and avoid day-one overpricing that prolongs vacancy. Your metric is effective yield on cost, not a decorative gross figure.

4) Underwrite the Exit Like a Local Seller

Profile your likely local buyer in 3–5 years (household size, car ownership, work nodes) and ensure the unit’s layout, parking, storage, and dues align. Map new-build pipeline within 1–2 km and adjust your required entry discount or choose stock that is differentiated enough to remain liquid when that supply hits.

5) Identify and Reject Red Flags

Walk from any “guarantee” whose economics only function with a 30–50% price premium to comps. Be wary when the guarantor is a marketing company rather than an operator with a durable balance sheet. Scrutinize amenities that inflate dues beyond what locals accept; and avoid awkward floor plans that sabotage viewing conversion rates.

Quick FAQs (Analyst’s Cut)

“If demand is strong, can’t I pay a premium and let rent growth catch up?”

Paying above intrinsic value introduces dual risk: weaker yield on cost today and a compromised exit later, because local buyers do not amortize your overpayment. You are effectively betting that rents and capital values will rise faster than the market, which is not a strategy—it's hope. Enter at fair or discounted value so both rent and resale work in your favor.

“Are any guarantees legitimate?”

They exist in narrow contexts (e.g., creditworthy master leases with transparent operating models), but they should still clear the price-per-m² test. If performance depends on a contractual promise rather than underlying market rent and comparable pricing, you are substituting counterparty risk for underwriting.

“What holding period should I model?”

Many investors use 3–5 years to capture rental stabilization, lawful indexation, and measured capital growth while limiting exposure to policy or credit cycles. Shorter holds demand a deeper purchase discount; longer holds should be justified by durable micro-location quality, not optimism alone.

“What yield should I underwrite?”

Base-case ~5% gross is a reasonable starting point for many connected submarkets. With a sharp entry price and professional operations, 6–6.5% is plausible; treat higher figures as upside contingent on execution, not as your base case.

Bottom Line

A resilient Istanbul investment is simple, not easy. Buy below market value by anchoring to clean comps and negotiating into the lower part of the value band. Convert headline rent into durable NOI by pricing to clear, managing vacancy, and indexing lawfully. Then sell to the local buyer by choosing stock that aligns with lived reality: layouts that work, dues that make sense, and connectivity that compresses daily life. If a “guarantee” is required for the pro-forma to look attractive, the issue is almost always the entry price, not the rental market.

Want a quick benchmark? Send any listing link and address/cadastral details. You’ll receive a price-per-m² comp set, rent realism, and exit positioning—no fluff.

AR

AR DE

DE RU

RU TR

TR